All Categories

Featured

Table of Contents

These notes let you purchase small companies, providing them with the resources needed to expand. In exchange, you can gain a taken care of return on your investment (Private Real Estate Deals for Accredited Investors). As an example, if you buy our note with a 14% annualized yield, you receive your interest settlements plus the principal at the end of the 2 year term.

Due to the fact that this kind of investment is generally not available to the public, realty can offer recognized financiers special possibilities to expand their profiles. However, actual estate financial investments can also include downsides. Offers usually require substantial funding and long-lasting dedications as a result of high up-front high capital investment like acquisition prices, maintenance, taxes, and costs.

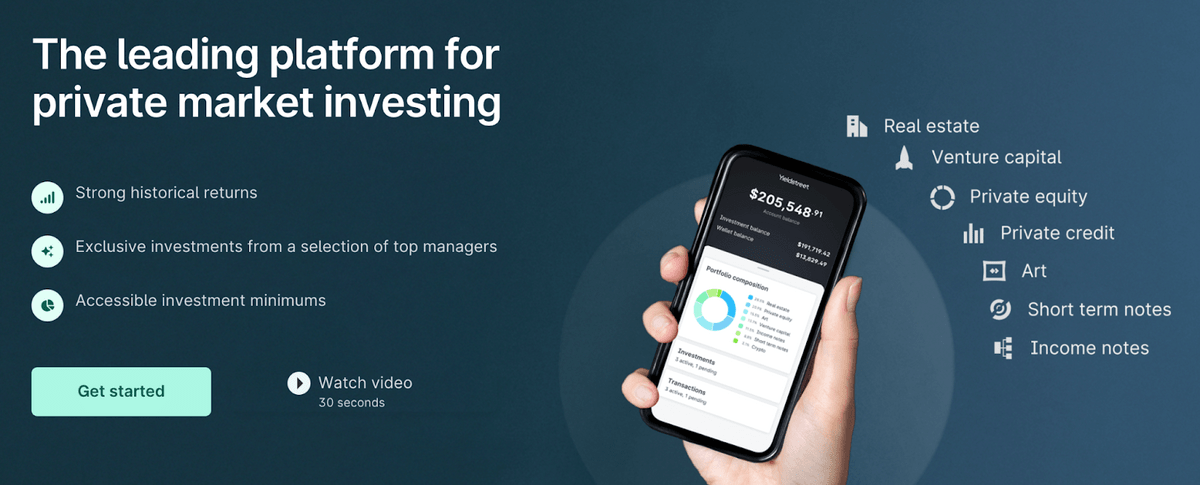

Some financial investments are only open to recognized capitalists. Here are the leading 7 approved investor possibilities: Exclusive access to exclusive market investments Wide variety of different financial investments like art, real estate, lawful financing, and a lot more Goal-based investing for growth or earnings Minimums starting from $10,000 Invest in pre-IPO companies via an EquityZen fund.

Investments include danger; Equitybee Stocks, participant FINRA Accredited financiers are the most qualified investors in the service. To qualify, you'll require to fulfill several demands in income, total assets, property dimension, governance status, or expert experience. As an approved capitalist, you have access to much more complex and innovative sorts of safeties.

What is included in Accredited Investor Commercial Real Estate Deals coverage?

Enjoy accessibility to these different investment possibilities as an approved capitalist. Continue reading. Certified investors generally have a revenue of over $200,000 independently or $300,000 collectively with a partner in each of the last 2 years. AssetsPrivate CreditMinimum InvestmentAs reduced as $500Target Holding PeriodAs short as 1 month Percent is an exclusive credit scores investment platform.

To earn, you just need to register, purchase a note offering, and wait for its maturity. It's a fantastic resource of passive earnings as you don't require to monitor it closely and it has a brief holding duration. Good yearly returns vary in between 15% and 24% for this asset class.

Possible for high returnsShort holding period Resources in danger if the consumer defaults AssetsContemporary ArtMinimum Investment$15,000 Target Holding Period3-10 Years Masterworks is a platform that securitizes excellent artworks for investments. It gets an artwork with public auction, then it registers that property as an LLC. Beginning at $15,000, you can invest in this low-risk asset class.

Acquire when it's offered, and afterwards you obtain pro-rated gains once Masterworks offers the art work. The target period is 3-10 years, when the artwork gets to the preferred value, it can be marketed previously. On its site, the very best recognition of an art work was a monstrous 788.9%, and it was only held for 29 days.

Its minimum begins at $10,000. Yieldstreet has the broadest offering throughout alternative financial investment systems, so the quantity you can make and its holding period differ. Private Property Investment Opportunities for Accredited Investors. There are products that you can hold for as brief as 3 months and as long as 5 years. Typically, you can earn with dividends and share recognition with time.

What are the benefits of Real Estate Development Opportunities For Accredited Investors for accredited investors?

One of the disadvantages right here is the reduced annual return price contrasted to specialized systems. Its monitoring cost typically varies from 1% - 4% yearly.

It flips farmland commercial. On top of that, it receives rental fee income from the farmers during the holding duration. As a financier, you can earn in two methods: Get dividends or cash return every December from the rent paid by renter farmers. Gain pro-rated revenue from the sale of the farmland at the end of the holding period.

Real Estate Crowdfunding For Accredited Investors

Farmland as a possession has traditionally reduced volatility, which makes this a terrific alternative for risk-averse investors. That being said, all investments still lug a certain level of threat.

In addition, there's a 5% charge upon the sale of the whole residential property. It invests in various deals such as multifamily, self-storage, and industrial homes.

Managed fund by CrowdStreet Advisors, which automatically diversifies your investment throughout numerous properties. When you purchase a CrowdStreet offering, you can get both a cash return and pro-rated gains at the end of the holding period. The minimum financial investment can vary, but it generally begins at $25,000 for marketplace offerings and C-REIT.

What happens if I don’t invest in Accredited Investor Real Estate Deals?

Real estate can be generally reduced danger, yet returns are not ensured. While some possessions might return 88% in 0.6 years, some possessions lose their value 100%. In the background of CrowdStreet, even more than 10 residential properties have unfavorable 100% returns. CrowdStreet does not charge any costs, yet you might require to pay sponsors charges for the management of the buildings.

While you won't obtain ownership right here, you can potentially get a share of the earnings once the start-up successfully does an exit occasion, like an IPO or M&A. Numerous excellent firms stay private and, consequently, commonly inaccessible to financiers. At Equitybee, you can money the supply alternatives of employees at Stripe, Reddit, and Starlink.

The minimum investment is $10,000. This system can potentially give you big returns, you can additionally shed your entire money if the startup stops working.

Why is High-return Real Estate Deals For Accredited Investors a good choice for accredited investors?

So when it's time to exercise the alternative during an IPO or M&A, they can profit from the prospective increase of the share price by having an agreement that allows them to purchase it at a price cut. Accredited Investor Real Estate Partnerships. Accessibility Hundreds of Start-ups at Past Valuations Expand Your Portfolio with High Development Start-ups Spend in a Formerly Hard To Reach Asset Course Subject to schedule

It likewise supplies the Climb Income Fund, which invests in CRE-related senior financial debt lendings. Historically, this earnings fund has surpassed the Yieldstreet Alternative Earnings Fund (formerly recognized as Yieldstreet Prism Fund) and PIMCO Revenue Fund.

Other attributes you can buy include buying and holding shares of business areas such as commercial and multifamily residential properties. However, some users have grumbled about their lack of openness. Apparently, EquityMultiple does not connect losses without delay. Plus, they no much longer publish the historical performance of each fund. Temporary note with high returns Lack of transparency Complex fees framework You can qualify as a recognized capitalist using two requirements: monetary and specialist capacities.

Table of Contents

Latest Posts

Property Back Taxes

Buying Back Taxes On Homes

Back Taxes Property For Sale

More

Latest Posts

Property Back Taxes

Buying Back Taxes On Homes

Back Taxes Property For Sale